Ethereum Price Prediction 2025 News Latest Forecasts Market Analysis

The cryptocurrency market continues to evolve rapidly, and investors worldwide are eagerly seeking the latest Ethereum price prediction 2025 news to make informed decisions. As we navigate through market volatility and technological advancements, Ethereum (ETH) remains one of the most closely watched digital assets. Recent developments in blockchain technology, regulatory frameworks, and institutional adoption have created significant momentum around Ethereum’s prospects.

Market analysts and cryptocurrency experts are providing updated forecasts that suggest 2025 could be a pivotal year for ETH investors. Understanding these predictions requires analyzing multiple factors, including network upgrades, market sentiment, and global economic conditions that directly impact Ethereum’s price trajectory.

Current Ethereum Market Landscape and Recent Developments

The Ethereum ecosystem has undergone remarkable transformations in recent months, setting the stage for potential growth in 2025. The successful implementation of various network upgrades has improved scalability and reduced transaction costs, making the platform more attractive to developers and users alike.

Key Market Indicators Influencing ETH Price

Several critical factors are shaping current market sentiment around Ethereum. Institutional adoption has accelerated significantly, with major financial institutions incorporating ETH into their portfolios. The growing DeFi (Decentralized Finance) sector continues to drive demand for Ethereum, as most DeFi protocols are built on the Ethereum blockchain.

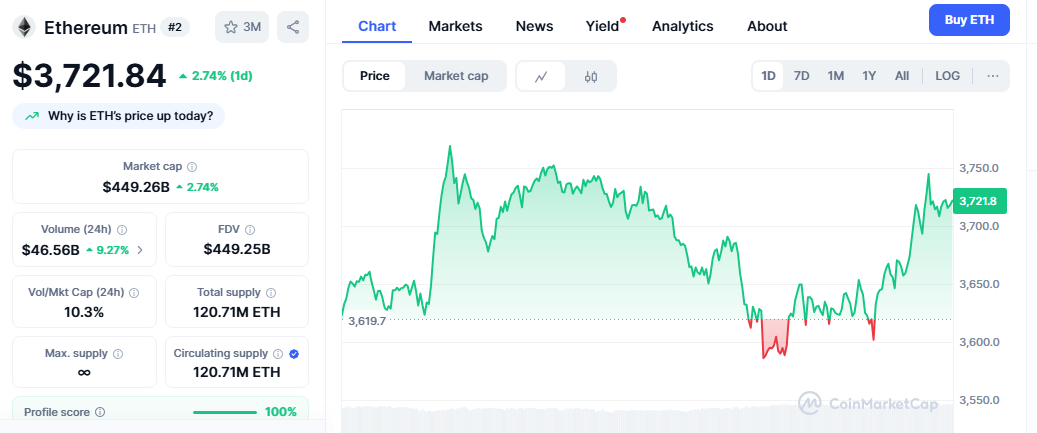

Trading volume patterns show increased institutional participation, with large-scale purchases becoming more frequent. This institutional interest provides a solid foundation for long-term price stability and growth potential. Additionally, the ongoing development of Layer 2 solutions has addressed scalability concerns that previously limited Ethereum’s growth prospects.

The regulatory landscape has also become more favorable, with clearer guidelines emerging from major jurisdictions. This regulatory clarity has reduced uncertainty and encouraged more mainstream adoption of Ethereum-based applications and services.

Expert Ethereum Price Prediction 2025 News Analysis

Leading cryptocurrency analysts have released comprehensive forecasts for Ethereum’s performance in 2025, presenting a range of scenarios based on different market conditions and adoption rates.

Bullish Predictions from Market Analysts

Several prominent analysts predict substantial growth for Ethereum by 2025. These optimistic forecasts are based on continued network improvements, increased institutional adoption, and the growing importance of smart contracts in various industries. Technical analysis suggests that Ethereum could potentially reach new all-time highs if current trends continue. The convergence of favorable macroeconomic conditions and technological advancements creates a compelling case for significant price appreciation.

Major investment firms have published research reports indicating that Ethereum’s utility value could drive prices considerably higher than current levels. The platform’s role as the foundation for numerous DeFi protocols and NFT marketplaces adds substantial intrinsic value that goes beyond speculative trading.

Conservative Market Forecasts

More conservative analysts emphasize potential challenges that could limit price growth. These include regulatory uncertainties in some jurisdictions, competition from other blockchain platforms, and potential macroeconomic headwinds. However, even conservative estimates suggest positive price movements for Ethereum in 2025, albeit at more modest levels than bullish predictions.

This indicates a consensus among experts that Ethereum’s fundamental value proposition remains strong. The diversity of predictions reflects the inherent uncertainty in cryptocurrency markets, but the overall sentiment remains predominantly positive for Ethereum’s long-term prospects.

Technical Analysis and Price Patterns

Understanding Ethereum’s price movements requires examining both technical indicators and fundamental analysis. Recent chart patterns suggest potential breakout scenarios that could materialize in 2025.

Support and Resistance Levels

Current technical analysis identifies key support levels that have historically provided strong price floors for Ethereum. These levels serve as important reference points for investors planning their 2025 strategies. Resistance levels also play a crucial role in determining potential price targets. Breaking through these levels could trigger significant upward momentum, while failure to overcome resistance might indicate consolidation periods. The formation of ascending triangles and other bullish patterns in recent months suggests accumulation by institutional investors, which often precedes major price movements.

Moving Averages and Momentum Indicators

Long-term moving averages show positive trends that support bullish price predictions for 2025. The 200-day moving average has been acting as strong support, indicating healthy underlying demand for Ethereum. Momentum indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) provide additional insights into potential price directions. These technical tools help investors identify optimal entry and exit points for their Ethereum positions. Volume analysis reveals increasing participation from institutional investors, which typically leads to more stable price action and reduced volatility over time.

Factors Driving Ethereum’s 2025 Growth Potential

Multiple catalysts could contribute to Ethereum’s price appreciation in 2025, ranging from technological improvements to broader market adoption trends.

Network Upgrades and Scalability Solutions

Continued development of Ethereum’s infrastructure addresses historical limitations and opens new possibilities for growth. The implementation of advanced scaling solutions has dramatically improved transaction throughput while reducing costs.

These improvements make Ethereum more competitive with other blockchain platforms and expand its potential user base. As more applications migrate to or are built on Ethereum, demand for ETH naturally increases. The roadmap for future upgrades includes additional enhancements that could further boost Ethereum’s capabilities and market position.

Institutional Adoption Trends

Growing institutional interest in Ethereum represents a significant shift in the cryptocurrency landscape. Major corporations are exploring Ethereum-based solutions for various business applications, from supply chain management to digital identity verification.

This institutional adoption provides price stability and legitimacy that appeals to retail investors. As more institutions announce Ethereum-related initiatives, positive price pressure typically follows. The launch of Ethereum ETFs in various markets has made it easier for traditional investors to gain exposure to ETH, potentially driving increased demand.

DeFi and Smart Contract Growth

The explosive growth of DeFi applications built on Ethereum creates ongoing demand for ETH tokens. Users need ETH to pay transaction fees and participate in various DeFi protocols, establishing a direct relationship between platform usage and token demand.

Smart contract adoption across industries continues expanding, with new use cases emerging regularly. This diversification reduces Ethereum’s dependence on speculative trading and builds sustainable long-term value. The development of more sophisticated DeFi products attracts institutional participants who require robust, tested platforms for their operations.

Global Economic Factors Affecting ETH Price Predictions

Macroeconomic conditions play a crucial role in cryptocurrency valuations, and 2025 predictions must account for various global economic scenarios.

Inflation and Monetary Policy Impact

Central bank policies regarding interest rates and money supply directly affect cryptocurrency markets. As traditional currencies face inflationary pressures, digital assets like Ethereum may benefit from increased demand as inflation hedges. The correlation between traditional financial markets and cryptocurrency prices has evolved, with Ethereum sometimes moving independently based on its unique fundamentals. Understanding these macroeconomic relationships helps investors better interpret price prediction models and adjust their strategies accordingly.

Regulatory Environment Evolution

The regulatory landscape for cryptocurrencies continues evolving, with significant implications for Ethereum’s future price performance. Positive regulatory developments typically boost investor confidence and attract institutional participation. Recent regulatory clarifications in major markets have reduced uncertainty around Ethereum’s legal status, creating a more favorable environment for growth. Future regulatory decisions could either accelerate or constrain Ethereum’s adoption, making regulatory analysis an essential component of price predictions.

Risk Assessment and Market Challenges

While optimistic predictions dominate current Ethereum price prediction 2025 news, investors must also consider potential risks and challenges that could impact price performance.

Competition from Alternative Blockchains

Other blockchain platforms continue developing competing solutions that could challenge Ethereum’s market dominance. These competitors often focus on specific advantages like faster transaction speeds or lower fees.

However, Ethereum’s first-mover advantage and extensive developer ecosystem provide strong competitive moats that are difficult for competitors to overcome. The network effects inherent in blockchain platforms tend to favor established leaders like Ethereum, but continued innovation remains essential for maintaining the market.

Also Read: Monero Price Prediction Next 5 Years Complete Analysis Expert Forecasts (2025-2030)

Technical and Security Considerations

Blockchain technology faces ongoing challenges related to scalability, security, and user experience. While Ethereum has made significant progress addressing these issues, future developments could present new challenges.

Security incidents or technical problems could negatively impact investor confidence and price performance. However, Ethereum’s track record of successfully addressing technical challenges provides confidence in its ability to overcome future obstacles. The decentralized nature of Ethereum provides resilience against single points of failure, but also creates coordination challenges for implementing major changes.

Investment Strategies Based on 2025 Predictions

Understanding various Ethereum price prediction 2025 news scenarios helps investors develop appropriate strategies for different market conditions.

Long-term Holding Strategies

Dollar-cost averaging remains a popular strategy for investors who believe in Ethereum’s long-term potential. This approach reduces the impact of short-term price volatility while building positions over time. Setting specific price targets based on prediction ranges helps investors make rational decisions about when to take profits or add to positions. Diversification across different cryptocurrency assets can reduce portfolio risk while maintaining exposure to Ethereum’s growth potential.

Trading Opportunities and Timing

Active traders can capitalize on price volatility by identifying key support and resistance levels suggested by technical analysis. Short-term trading requires careful risk management and a deep understanding of market dynamics. Swing trading strategies that hold positions for weeks or months can capture intermediate-term price movements while avoiding the stress of day trading. Options and futures markets provide additional tools for sophisticated investors to hedge positions or amplify returns based on their price predictions.

Industry Expert Opinions and Forecasts

Gathering perspectives from various industry experts provides a comprehensive view of potential Ethereum price scenarios for 2025.

Analyst Consensus Views

Most cryptocurrency analysts express cautious optimism about Ethereum’s 2025 prospects, citing fundamental improvements and growing adoption as key drivers. The range of predictions reflects different assumptions about market conditions, regulatory developments, and technological progress. Consensus estimates typically fall within specific price ranges, providing useful benchmarks for individual investment decisions.

Institutional Research Reports

Major financial institutions publish detailed research on Ethereum that includes sophisticated modeling and analysis. These reports often influence broader market sentiment and investment flows. Institutional research typically takes a more conservative approach than independent analysts, focusing on risk-adjusted returns and regulatory compliance. The credibility of institutional research adds weight to bullish predictions and helps validate positive price scenarios.

Conclusion

The latest Ethereum price prediction 2025 news presents a compelling case for potential growth, supported by technological improvements, institutional adoption, and expanding use cases. While predictions vary significantly among experts, the overall sentiment remains positive for Ethereum’s long-term prospects.

Investors should carefully evaluate their risk tolerance and investment goals when considering Ethereum positions based on these predictions. The cryptocurrency market’s inherent volatility means that actual results may differ substantially from current forecasts, regardless of how thorough the analysis.