Bitcoin Price Prediction 2025 Analysis Expert Forecasts & Market Outlook

The cryptocurrency market is buzzing with anticipation as analysts worldwide conduct comprehensive bitcoin price prediction 2025 analysis to determine where the leading digital asset might head. With Bitcoin reaching new all-time highs and institutional adoption accelerating, understanding the potential price trajectory for 2025 has become crucial for investors, traders, and financial institutions alike.

This detailed bitcoin price prediction 2025 analysis examines multiple factors including technical indicators, institutional adoption patterns, regulatory developments, and macroeconomic conditions that could influence Bitcoin’s value throughout 2025. Expert analysts from major financial institutions are presenting varied forecasts, ranging from conservative estimates to bullish projections that could see Bitcoin reaching unprecedented levels.

Current Bitcoin Market Landscape and 2025 Outlook

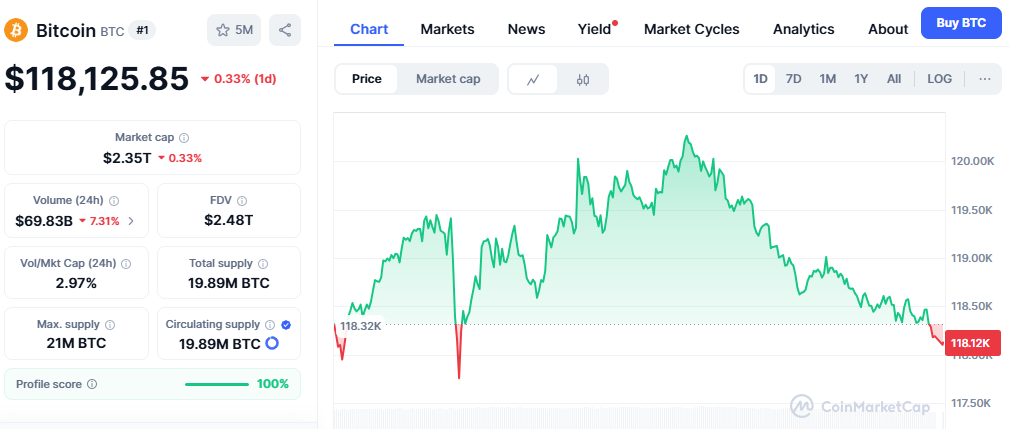

The current Bitcoin market environment sets the foundation for any reliable Bitcoin price prediction 2025 analysis. As of mid-2025, Bitcoin has demonstrated remarkable resilience, trading above $100,000 and establishing new psychological price levels that were once considered unrealistic. The cryptocurrency has benefited from increased institutional adoption, with major corporations adding Bitcoin to their treasury reserves and traditional financial institutions offering Bitcoin-related services.

Institutional Adoption Driving Price Momentum

Institutional adoption remains one of the most significant drivers in current market analysis. Companies like MicroStrategy, Tesla, and numerous hedge funds have allocated substantial portions of their portfolios to Bitcoin, creating sustained buying pressure. This institutional demand provides a solid foundation for long-term price appreciation and reduces the likelihood of extreme downward volatility that characterized earlier market cycles.

The approval and success of Bitcoin ETFs have further legitimized Bitcoin as an investment vehicle, making it accessible to traditional investors who previously couldn’t or wouldn’t directly purchase cryptocurrency. This accessibility has expanded the potential investor base significantly, contributing to more stable price action and reduced volatility compared to previous years.

Regulatory Clarity Enhancing Market Confidence

Regulatory developments worldwide have generally moved in a favorable direction for Bitcoin, with major economies providing clearer frameworks for cryptocurrency operations. The United States, European Union, and other key markets have established more defined regulatory structures, reducing uncertainty that previously hampered institutional adoption.

This regulatory clarity has enabled traditional financial institutions to offer Bitcoin-related services with greater confidence, leading to increased market participation and liquidity. The result is a more mature market that responds more predictably to fundamental analysis rather than purely speculative trading.

Technical Analysis for Bitcoin Price Prediction 2025

Chart Patterns and Support Levels

Technical analysis plays a crucial role in any comprehensive bitcoin price prediction 2025 analysis. Current chart patterns suggest Bitcoin is in a sustained uptrend, with key support levels established around $90,000 and resistance levels being tested above $120,000. The formation of higher lows and higher highs indicates continued bullish momentum that could persist throughout 2025.

Moving averages across different timeframes continue to show positive alignment, with the 50-day, 100-day, and 200-day moving averages all trending upward. This technical configuration typically indicates strong underlying momentum and suggests that any short-term corrections are likely to be viewed as buying opportunities rather than trend reversals.

Volume Analysis and Market Participation

Trading volume analysis reveals increasing participation from institutional investors, evidenced by larger block trades and reduced volatility during off-peak hours. This institutional participation pattern suggests that Bitcoin is transitioning from a primarily retail-driven market to one dominated by professional investors with longer investment horizons.

The volume profile shows strong accumulation zones around current price levels, indicating that large investors are actively building positions rather than looking to distribute their holdings. This accumulation behavior typically precedes sustained price appreciation phases.

Expert Bitcoin Price Predictions for 2025

Conservative Estimates from Traditional Finance

Conservative analysts from traditional financial institutions typically provide bitcoin price prediction 2025 analysis that accounts for potential regulatory challenges and market corrections. These forecasts generally range from $150,000 to $200,000, representing significant appreciation from current levels while maintaining realistic expectations based on historical market cycles.

JPMorgan Chase analysts have suggested that Bitcoin could reach $180,000 by the end of 2025, based on increased institutional adoption and potential inclusion in more pension funds and sovereign wealth funds. This prediction factors in the continued digitization of finance and Bitcoin’s growing role as a store of value in inflationary environments.

Goldman Sachs has provided a more measured outlook, suggesting Bitcoin could reach $175,000 to $200,000 range, contingent on continued regulatory clarity and sustained institutional demand. Their analysis emphasizes the importance of market infrastructure development and the maturation of cryptocurrency derivatives markets.

Bullish Projections from Crypto Specialists

Cryptocurrency-focused analysts tend to provide more aggressive projections in their bitcoin price prediction 2025 analysis, often citing Bitcoin’s finite supply, increasing adoption, and potential for mainstream payment integration. These bullish forecasts frequently range from $250,000 to $400,000 or higher.

Prominent crypto analysts like PlanB, known for the Stock-to-Flow model, maintain that Bitcoin could reach $250,000 or higher by 2025, based on the mathematical relationship between Bitcoin’s scarcity and its historical price performance. This model has accurately predicted previous market cycles, lending credibility to these higher projections.

Other industry experts point to potential catalysts such as central bank adoption, emerging market currency debasement, and the continued development of the Lightning Network as factors that could drive Bitcoin to $300,000 or beyond during 2025.

Fundamental Factors Influencing Bitcoin’s 2025 Price

Macroeconomic Environment and Monetary Policy

The macroeconomic environment plays a critical role in any bitcoin price prediction 2025 analysis. Current global monetary policies, inflation rates, and currency debasement trends all contribute to Bitcoin’s appeal as an alternative store of value. Central banks worldwide continue to maintain accommodative monetary policies, creating conditions that historically favor alternative assets like Bitcoin.

Interest rate policies from major central banks will significantly impact Bitcoin’s relative attractiveness compared to traditional savings vehicles. Lower interest rates typically increase Bitcoin’s appeal as investors seek higher returns and inflation hedges, while higher rates might temporarily reduce speculative demand.

Supply Dynamics and Mining Economics

Bitcoin’s predetermined supply schedule continues to play a fundamental role in price determination. With approximately 19.8 million Bitcoin already mined out of the maximum 21 million, scarcity becomes increasingly apparent as demand continues to grow. The 2024 halving event reduced new Bitcoin supply by half, creating additional scarcity pressure that typically manifests in price appreciation over the following 12-18 months.

Mining economics also influence Bitcoin’s price floor, as miners must sell Bitcoin to cover operational costs. Current mining profitability suggests strong support levels around current price ranges, as miners can operate profitably and continue securing the network without creating excessive selling pressure.

Network Development and Utility Expansion

The continued development of Bitcoin’s network infrastructure, including Lightning Network adoption and layer-2 solutions, enhances Bitcoin’s utility beyond simple value storage. Increased utility typically translates to increased demand and higher sustainable price levels. Payment processing companies and financial institutions are increasingly integrating Bitcoin payment capabilities, expanding its use case from primarily investment asset to practical medium of exchange. This utility expansion supports higher valuation multiples and more stable price appreciation.

Regional Market Analysis and Global Adoption Trends

North American Market Dynamics

North American markets continue to lead Bitcoin adoption, with the United States showing particular strength in both retail and institutional participation. The approval of multiple Bitcoin ETFs has created accessible investment vehicles for traditional investors, while regulatory clarity has enabled more financial institutions to offer Bitcoin services. Canadian markets have also shown strong adoption trends, with several major banks offering Bitcoin custody services and investment products. This North American leadership in Bitcoin adoption suggests continued strong demand from the world’s largest economy and most developed financial markets.

European Market Integration

European markets are rapidly catching up with North American adoption levels, with several EU countries developing comprehensive cryptocurrency frameworks. The European Central Bank’s digital euro project has increased awareness of digital currencies generally, benefiting Bitcoin adoption.

Germany’s recognition of Bitcoin as legal tender for institutional investors and Switzerland’s crypto-friendly regulations have positioned Europe as a significant market for Bitcoin growth. These developments support positive price projections for 2025.

Also Read: Monero Price Prediction Next 5 Years Complete Analysis Expert Forecasts (2025-2030)

Asian Market Potential

Asian markets present both opportunities and challenges for Bitcoin adoption. While China maintains restrictive policies, other Asian economies like Japan, Singapore, and South Korea have embraced cryptocurrency innovation. India’s evolving regulatory stance could significantly impact global Bitcoin demand given its large population and growing economy.The potential for Asian central banks to add Bitcoin to their reserves, similar to El Salvador’s approach, could create substantial buying pressure that would exceed most current price projections.

Risk Factors and Potential Challenges

Regulatory Risks and Government Actions

Despite generally positive regulatory trends, potential government actions remain a significant risk factor in any bitcoin price prediction 2025 analysis. Major economies could implement unexpected restrictions or taxation policies that might temporarily impact Bitcoin’s price trajectory.

The potential for coordinated international regulatory actions, while unlikely given current trends, represents a tail risk that could significantly impact price projections. However, Bitcoin’s decentralized nature and increasing institutional adoption make such coordinated actions increasingly difficult to implement effectively.

Market Competition and Alternative Cryptocurrencies

The cryptocurrency market continues to evolve, with new blockchain technologies and digital assets competing for investor attention and capital. While Bitcoin maintains its position as the dominant cryptocurrency, significant technological breakthroughs in competing platforms could potentially impact its market share.However, Bitcoin’s first-mover advantage, network effects, and established infrastructure provide significant competitive advantages that support its continued dominance and price appreciation potential.

Technological Risks and Network Security

Bitcoin’s underlying technology, while proven over more than a decade, faces ongoing challenges including scalability, energy consumption concerns, and potential quantum computing threats. These technological considerations factor into long-term price projections and risk assessments.The Bitcoin development community continues to address these challenges through protocol improvements and layer-2 solutions, maintaining Bitcoin’s technological competitiveness and supporting positive price projections.

Investment Strategies Based on 2025 Analysis

Dollar-Cost Averaging Approaches

For individual investors, dollar-cost averaging strategies based on bitcoin price prediction 2025 analysis can help mitigate volatility while participating in potential upside. This approach involves regular, systematic purchases regardless of short-term price movements, allowing investors to build positions over time.

Historical analysis suggests that dollar-cost averaging into Bitcoin over 12-24 month periods has consistently produced positive returns, even when initiated during previous market peaks. This strategy aligns well with bullish 2025 projections while managing downside risk.

Portfolio Allocation Considerations

Financial advisors increasingly recommend Bitcoin allocations of 1-5% of total portfolio value, based on individual risk tolerance and investment objectives. Higher allocations may be appropriate for investors with greater risk tolerance and conviction in Bitcoin’s long-term prospects.

The correlation between Bitcoin and traditional assets remains relatively low, providing diversification benefits that can improve overall portfolio risk-adjusted returns. This diversification benefit supports the inclusion of Bitcoin in balanced investment portfolios.

Institutional Investment Approaches

Institutional investors are developing sophisticated Bitcoin investment strategies that go beyond simple buy-and-hold approaches. These strategies include options overlay strategies, systematic rebalancing programs, and risk management techniques adapted for cryptocurrency markets.The development of more sophisticated investment tools and strategies supports increased institutional adoption and more stable price appreciation over time.

Future Market Infrastructure Development

Custody Solutions and Security Improvements

The continued development of institutional-grade custody solutions reduces one of the primary barriers to large-scale Bitcoin adoption. Major financial institutions are investing heavily in secure custody infrastructure, enabling larger allocations from institutional investors.These infrastructure improvements reduce operational risks and support higher sustainable Bitcoin prices by enabling larger institutional participation in the market.

Derivatives Markets and Risk Management Tools

The maturation of Bitcoin derivatives markets provides institutional investors with sophisticated risk management tools that enable larger position sizes and more complex investment strategies. These tools include options, futures, and structured products that allow for precise risk management.The availability of these risk management tools encourages larger institutional allocations and supports more stable price appreciation over time.

Environmental Considerations and Sustainable Mining

Renewable Energy Adoption in Mining

Bitcoin mining’s transition toward renewable energy sources addresses environmental concerns that have historically limited institutional adoption. Major mining operations are increasingly powered by renewable energy, improving Bitcoin’s environmental profile.This transition toward sustainable mining practices removes a significant barrier to institutional adoption and supports positive long-term price projections.

Carbon Neutrality Initiatives

Several major Bitcoin mining companies have committed to carbon neutrality goals, further improving Bitcoin’s environmental credentials. These initiatives make Bitcoin more attractive to ESG-focused institutional investors.The alignment of Bitcoin mining with environmental sustainability goals expands the potential investor base and supports higher sustainable price levels.

Conclusion

This comprehensive bitcoin price prediction 2025 analysis reveals a generally optimistic outlook supported by fundamental factors including institutional adoption, regulatory clarity, and favorable macroeconomic conditions. While price predictions vary significantly among experts, the consensus suggests substantial appreciation potential with price targets commonly ranging from $150,000 to $300,000.

Investors considering Bitcoin exposure should conduct their thorough analysis and consider multiple scenarios rather than relying solely on price predictions. The cryptocurrency market remains volatile and unpredictable, requiring careful risk management and appropriate position sizing.