Chainlink Price Prediction Next 5 Years Expert Analysis & Forecasts (2025-2030)

The cryptocurrency landscape continues to evolve rapidly, with decentralized oracle networks playing an increasingly crucial role in blockchain adoption. Among these, Chainlink stands out as a pioneering force, making its Chainlink price prediction next 5 years a topic of intense interest for investors and blockchain enthusiasts alike. As we navigate through 2025, understanding Chainlink’s potential trajectory becomes essential for making informed investment decisions.

Chainlink’s revolutionary oracle technology has positioned it as a bridge between traditional data sources and blockchain networks, creating unprecedented opportunities for smart contract applications. With major partnerships already established and continuous technological improvements, the question isn’t whether Chainlink will grow, but rather how significantly its value will increase over the coming years. This comprehensive analysis examines multiple factors that will influence Chainlink’s price evolution from 2025 to 2030.

Understanding Chainlink’s Market Position and Technology

Chainlink operates as a decentralized oracle network that enables smart contracts to securely access off-chain data feeds, web APIs, and traditional bank payments. This fundamental utility has made LINK tokens indispensable in the decentralized finance (DeFi) ecosystem, where accurate, tamper-proof data is crucial for protocol functionality.

The network’s architecture consists of multiple independent oracle nodes that aggregate data from various sources, ensuring reliability and preventing single points of failure. This decentralized approach has attracted partnerships with major corporations, including Google Cloud, Oracle Corporation, and SWIFT, indicating strong institutional confidence in the technology.

Currently, Chainlink processes billions of dollars in transaction value across hundreds of DeFi protocols, demonstrating real-world utility that extends far beyond speculative trading. The network’s total value secured (TVS) has consistently grown, reflecting increased adoption and trust from the broader blockchain community.

Key Technological Advantages

Chainlink’s competitive moats include its first-mover advantage in decentralized oracles, extensive node operator network, and robust security mechanisms. The platform’s Cross-Chain Interoperability Protocol (CCIP) further enhances its value proposition by enabling seamless communication between different blockchain networks.

The recent introduction of Chainlink Functions allows developers to perform custom computations using serverless infrastructure, expanding the network’s utility beyond simple data feeds. This evolution positions Chainlink as a comprehensive infrastructure provider for the decentralized web.

Chainlink Price Prediction Next 5 Years: Detailed Analysis

Based on comprehensive market analysis, technological developments, and adoption trends, the Chainlink price prediction for the next 5 years suggests significant growth potential driven by increasing institutional adoption and expanding use cases.

2025 Price Forecast

For 2025, conservative estimates place Chainlink’s price range between $35-$55, representing a substantial increase from current levels. This projection assumes continued DeFi growth, institutional blockchain adoption, and Chainlink’s expanding role in integrating traditional finance.

Bull case scenarios could see LINK reaching $75-$90 by late 2025, particularly if major central bank digital currency (CBDC) implementations adopt Chainlink’s infrastructure. The network’s role in enabling secure, reliable data feeds for government and enterprise applications could drive unprecedented demand for LINK tokens. Bear case projections suggest a more modest range of $25-$35, accounting for potential market corrections, increased competition from alternative oracle solutions, or broader cryptocurrency market downturns.

2026-2027 Growth Projections

The mid-term outlook for Chainlink remains exceptionally positive, with price targets ranging from $60-$120 by 2027. This period is expected to witness mainstream adoption of blockchain technology across multiple industries, positioning Chainlink as critical infrastructure for the digital economy.

Key growth drivers during this period include expanded partnerships with traditional financial institutions, integration with emerging Web3 applications, and potential adoption by major cloud computing providers for their blockchain services. The introduction of Chainlink’s staking mechanism is also expected to reduce circulating supply while providing additional utility for LINK holders, creating natural price appreciation pressure through supply-demand dynamics.

Market Factors Influencing Long-Term Price Movement

Several macroeconomic and technological factors will significantly impact Chainlink’s price trajectory over the next five years. Understanding these variables is crucial for developing realistic expectations about the network’s future valuation.

Institutional Adoption and Enterprise Integration

The increasing adoption of blockchain technology by traditional enterprises represents a massive opportunity for Chainlink. As companies seek to integrate smart contracts into their operations, reliable oracle services become essential infrastructure.

Major consulting firms like Deloitte and PwC have already begun offering blockchain implementation services to their clients, often recommending Chainlink for oracle needs. This trend is expected to accelerate as regulatory frameworks become clearer and blockchain benefits become more apparent to traditional businesses. The total addressable market for Oracle services in enterprise blockchain applications is estimated to reach hundreds of billions of dollars by 2030, providing substantial growth runway for Chainlink’s expansion.

Regulatory Environment and Compliance

Regulatory clarity around cryptocurrency and blockchain technology continues to improve globally, creating a more favorable environment for institutional adoption. Recent regulatory frameworks in the European Union and the United States have provided clearer guidelines for cryptocurrency operations. Chainlink’s focus on regulatory compliance and its willingness to work with traditional financial institutions position it favorably as regulations continue to evolve. The network’s ability to provide auditable, transparent data feeds aligns well with regulatory requirements for financial applications.

Competition and Market Dynamics

While Chainlink maintains a dominant position in the oracle space, emerging competitors like Band Protocol, API3, and others are developing alternative solutions. However, Chainlink’s extensive partnership network, proven track record, and continuous innovation provide significant competitive advantages.

The network effects inherent in oracle networks tend to favor established players with large developer communities and extensive data provider relationships. Chainlink’s early-mover advantage and comprehensive ecosystem make it difficult for competitors to displace its market position.

Technical Analysis and Price Patterns

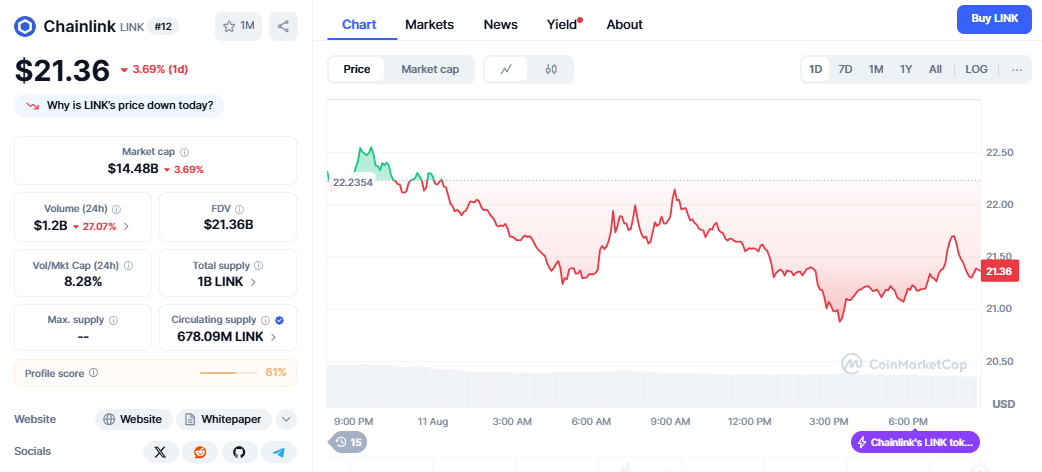

From a technical analysis perspective, Chainlink has demonstrated strong long-term upward momentum with periodic consolidation phases. Historical price patterns suggest that LINK tends to experience significant rallies followed by healthy corrections, creating opportunities for strategic accumulation.

Support and Resistance Levels

Key technical indicators suggest strong support levels around current price ranges, with resistance levels providing roadmaps for future price targets. The token’s correlation with broader cryptocurrency market movements remains significant but has been decreasing as fundamental adoption grows.

Moving average convergence divergence (MACD) indicators and relative strength index (RSI) patterns historically provide reliable signals for Chainlink’s price movements, though fundamental developments often override short-term technical considerations.

Volume Analysis and Market Sentiment

Trading volume patterns indicate increasing institutional interest in LINK tokens, with larger average transaction sizes and reduced retail-driven volatility. This maturation of the trading profile suggests growing confidence from sophisticated investors. Social sentiment analysis and developer activity metrics remain consistently positive for Chainlink, indicating strong community support and continued technological advancement.

Investment Strategies for Chainlink’s Five-Year Outlook

Developing appropriate investment strategies for Chainlink requires understanding both the opportunities and risks associated with the network’s growth trajectory. Different approaches suit different risk tolerances and investment timeframes.

Dollar-Cost Averaging Approach

Given the volatility inherent in cryptocurrency markets, dollar-cost averaging (DCA) strategies can help investors build positions while minimizing timing risk. Regular purchases over extended periods smooth out price fluctuations and reduce the impact of short-term market volatility. This approach is particularly suitable for investors who believe in Chainlink’s long-term fundamentals but want to avoid the stress of timing market entries and exits.

Strategic Accumulation During Corrections

Market corrections provide opportunities for strategic accumulation at discounted prices. Historical analysis suggests that Chainlink tends to recover strongly from bear market lows, rewarding patient investors who accumulate during periods of market pessimism. Identifying key support levels and accumulating during periods of maximum fear often produces superior long-term returns compared to momentum-based buying strategies.

Risks and Challenges Facing Chainlink

While the long-term outlook for Chainlink remains positive, several risks and challenges could impact its price trajectory over the next five years. Understanding these potential headwinds is crucial for making informed investment decisions.

Technology and Competition Risks

The rapidly evolving nature of blockchain technology means that new oracle solutions could potentially challenge Chainlink’s dominance. While the network’s current advantages are substantial, technological disruption remains a possibility. Smart contract platforms are also developing native oracle capabilities, which could reduce demand for third-party oracle services. Chainlink’s response to these developments will be crucial for maintaining its market position.

Regulatory and Legal Challenges

Despite improving regulatory clarity, potential adverse regulatory decisions could impact Chainlink’s operations and token value. Changes in securities law interpretation or restrictions on cryptocurrency usage could create headwinds for adoption. The global nature of Chainlink’s operations provides some protection against localized regulatory challenges, but coordinated international regulatory action could pose significant risks.

Also Read: How to Buy Chainlink Cryptocurrency: Complete Beginner’s Guide 2025

Market Volatility and Economic Factors

Broader cryptocurrency market volatility will continue to influence Chainlink’s price movements, potentially creating significant short-term fluctuations even if long-term fundamentals remain strong. Macroeconomic factors like interest rates, inflation, and global economic stability also impact cryptocurrency valuations. Economic recessions or financial market disruptions could delay enterprise blockchain adoption, reducing demand for oracle services and impacting LINK token value.

Partnership Ecosystem and Network Effects

Chainlink’s extensive partnership ecosystem creates powerful network effects that reinforce its market position and drive long-term value creation. These relationships span across multiple industries and include some of the world’s largest technology and financial services companies.

Major Corporate Partnerships

Strategic partnerships with companies like Google Cloud, Amazon Web Services, and Microsoft Azure provide Chainlink with access to massive enterprise customer bases. These relationships often result in joint go-to-market initiatives that accelerate the adoption of Oracle services. Financial services partnerships with companies like SWIFT and various insurance providers demonstrate Chainlink’s ability to integrate with traditional financial infrastructure, opening opportunities in multi-trillion-dollar markets.

DeFi Protocol Integration

Chainlink’s integration with hundreds of DeFi protocols creates a self-reinforcing ecosystem where increased adoption by one protocol enhances the value proposition for others. This network effect makes it increasingly difficult for competitors to displace Chainlink’s position. The total value locked (TVL) in DeFi protocols using Chainlink price feeds continues to grow, creating sustained demand for oracle services and LINK tokens.

Future Technological Developments

Chainlink’s roadmap includes several technological developments that could significantly enhance its value proposition and drive increased adoption over the next five years. These innovations address current limitations while opening new market opportunities.

Cross-Chain Interoperability Protocol (CCIP)

The launch of CCIP represents a major evolution in Chainlink’s capabilities, enabling secure communication between different blockchain networks. This development positions Chainlink as critical infrastructure for the multi-chain future of blockchain technology. Early adoption of CCIP by major DeFi protocols and enterprise applications suggests strong market demand for cross-chain interoperability solutions, potentially creating significant revenue opportunities for the network.

Chainlink Automation and Functions

Recent introductions of Chainlink Automation and Functions expand the network’s utility beyond data feeds to include computational services and automated smart contract execution. These developments create additional revenue streams and use cases for LINK tokens. The ability to perform complex computations and automate smart contract functions using Chainlink’s decentralized infrastructure opens opportunities in areas like algorithmic trading, insurance claim processing, and supply chain management.

Global Economic Impact and Adoption Trends

Chainlink’s growth trajectory is closely tied to broader trends in digital transformation, blockchain adoption, and the evolution of the global financial system. Understanding these macro trends provides context for evaluating the network’s long-term potential.

Central Bank Digital Currencies (CBDCs)

The development of CBDCs by central banks worldwide creates opportunities for oracle services to facilitate integration between traditional monetary systems and blockchain infrastructure. Chainlink’s established relationships with financial institutions position it favorably for CBDC implementations. Several pilot programs already utilize Chainlink’s infrastructure for data feeds and cross-border payment facilitation, suggesting potential for significant scaling as CBDC adoption accelerates.

Enterprise Blockchain Adoption

Corporate adoption of blockchain technology for supply chain management, identity verification, and financial services continues to accelerate. These applications often require reliable external data sources, creating a natural demand for Oracle services. The market for enterprise blockchain solutions is projected to reach hundreds of billions of dollars by 2030, providing substantial growth opportunities for infrastructure providers like Chainlink.

Price Prediction Summary and Investment Outlook

Based on a comprehensive analysis of technological developments, market trends, and adoption patterns, the Chainlink price prediction for the next 5 years suggests significant appreciation potential driven by expanding utility and institutional adoption. Conservative estimates place Chainlink’s value between $50-$80 by 2030, while optimistic scenarios could see prices reaching $100-$150 or higher. These projections assume continued technological innovation, expanding partnerships, and growing demand for decentralized oracle services.

The key factors supporting these bullish projections include Chainlink’s dominant market position, extensive partnership ecosystem, continuous technological advancement, and the massive addressable market for blockchain infrastructure services. However, investors should remain aware of potential risks, including technological disruption, regulatory challenges, and broader market volatility that could impact short-term price movements even if long-term fundamentals remain strong.

Conclusion

The chainlink price prediction next 5 years presents a compelling opportunity for investors seeking exposure to the growing blockchain infrastructure sector. Chainlink’s established market leadership, expanding partnership ecosystem, and continuous technological innovation create multiple catalysts for sustained growth through 2030.

While short-term volatility will continue to characterize cryptocurrency markets, Chainlink’s fundamental value proposition as critical infrastructure for the decentralized economy provides strong support for long-term appreciation. The network’s role in enabling secure, reliable data feeds for smart contracts becomes increasingly valuable as blockchain adoption accelerates across industries.