Ethereum Price Prediction News Today Latest ETH Analysis & Market Forecasts 2025

The cryptocurrency market continues to evolve at breakneck speed, and staying informed about Ethereum price prediction news today has become crucial for investors, traders, and blockchain enthusiasts alike. As the world’s second-largest cryptocurrency by market capitalization, Ethereum’s price movements significantly impact the entire crypto ecosystem. Today’s market analysis reveals compelling insights that could shape ETH’s trajectory in the coming weeks and months. Whether you’re a seasoned investor or new to the cryptocurrency space, understanding current Ethereum price predictions can help inform your investment decisions and market strategy.

Current Ethereum Market Analysis: What’s Driving Today’s Price Action

The Ethereum ecosystem has experienced remarkable growth and transformation over the past year. Today’s price action reflects several key market dynamics that are shaping ETH’s valuation. Market sentiment around Ethereum has been influenced by technological upgrades, institutional adoption, and broader macroeconomic factors.

Recent trading volumes indicate increased institutional interest in Ethereum, with major financial institutions allocating portions of their portfolios to ETH. This institutional adoption has provided a solid foundation for price stability and long-term growth potential. Additionally, the successful implementation of various Ethereum Improvement Proposals (EIPs) has enhanced the network’s efficiency and reduced transaction costs.

The DeFi (Decentralized Finance) sector continues to be a major driver of Ethereum demand. With over $40 billion in total value locked (TVL) across various DeFi protocols, Ethereum remains the preferred blockchain for innovative financial applications. This sustained demand for block space translates directly into network fees and ETH token utility.

Technical Analysis: Ethereum Price Prediction News Today Reveals Key Levels

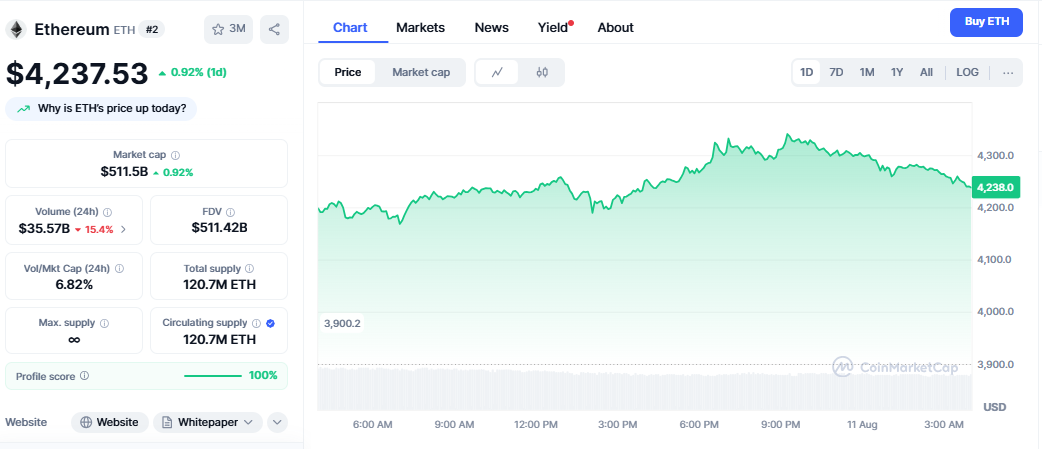

From a technical analysis perspective, Ethereum’s price chart reveals several critical support and resistance levels that traders are monitoring closely. The current price action suggests a consolidation phase following recent market volatility. Key technical indicators point to mixed signals in the short term. The Relative Strength Index (RSI) sits at neutral levels, indicating neither oversold nor overbought conditions. The Moving Average Convergence Divergence (MACD) shows signs of potential bullish divergence, which could signal an upcoming price rally.

Support levels have been established around the $2,200 mark, with strong buying interest observed at this price point during recent dips. Resistance levels are clearly defined around $2,800, where profit-taking activities have previously capped upward movements. A decisive break above this resistance could open the path toward higher price targets. The 50-day and 200-day moving averages are converging, suggesting that a significant price movement may be imminent. Historical data shows that such convergences often precede major trend reversals or accelerations in either direction.

Expert Predictions: What Analysts Say About ETH Price Movements

Leading cryptocurrency analysts and market experts have shared diverse perspectives on Ethereum’s price trajectory. These expert opinions form a crucial component of today’s Ethereum price prediction landscape. Prominent blockchain analysts suggest that Ethereum’s fundamentals remain strong despite short-term price volatility. The network’s continued development and growing adoption in enterprise applications provide a solid foundation for long-term value appreciation. Many experts point to the upcoming protocol upgrades as catalysts for renewed investor interest.

Several institutional research firms have published bullish long-term forecasts for Ethereum. These projections are based on factors including increasing smart contract adoption, growing DeFi ecosystem, and the potential for Ethereum to capture value from the expanding Web3 economy. However, experts also caution about potential regulatory headwinds and competition from other blockchain platforms.

Risk management remains a central theme in expert recommendations. Financial advisors emphasize the importance of position sizing and diversification when investing in volatile assets like Ethereum. They recommend dollar-cost averaging strategies for long-term investors looking to build ETH positions.

Also Read: Ethereum Price Prediction News Today Expert Analysis 2025 Forecast

Ethereum Network Developments Impacting Price Predictions

The Ethereum network continues to evolve through regular upgrades and improvements that directly impact its value proposition. Recent developments have strengthened the network’s capabilities and addressed previous limitations.

Layer 2 scaling solutions have gained significant traction, with platforms like Arbitrum, Optimism, and Polygon processing millions of transactions daily. These solutions reduce congestion on the main Ethereum network while maintaining security and decentralization. The growing adoption of Layer 2 solutions has positive implications for Ethereum’s long-term scalability and user experience.

The transition to Proof-of-Stake consensus mechanism has been completed successfully, reducing Ethereum’s energy consumption by over 99%. This environmental improvement has made ETH more attractive to environmentally conscious investors and institutions with sustainability mandates. The staking mechanism also creates deflationary pressure on the ETH supply, potentially supporting higher prices over time.

Smart contract upgrades continue to enhance Ethereum’s functionality and security. Recent implementations have improved gas efficiency and expanded the network’s capabilities for complex financial applications. These technical improvements strengthen Ethereum’s position as the leading platform for decentralized applications.

Market Sentiment and Ethereum Price Drivers Today

Current market sentiment around Ethereum reflects a complex mix of optimism and caution. Social media analytics and sentiment indicators suggest that retail investor interest remains high, while institutional sentiment appears more measured and strategic. Global economic conditions continue to influence cryptocurrency markets, including Ethereum. Inflation concerns, central bank policies, and geopolitical tensions all contribute to market volatility. However, Ethereum’s growing utility and adoption provide some insulation from purely speculative trading patterns.

The regulatory landscape remains a key factor in Ethereum price predictions. Recent clarity from regulatory bodies in various jurisdictions has provided more certainty for institutional investors. However, ongoing regulatory discussions could introduce volatility as new policies are developed and implemented. Correlation with traditional financial markets has decreased compared to previous years, suggesting that Ethereum is developing its price discovery mechanisms based on fundamental factors rather than purely following broader market trends.

DeFi and NFT Impact on Ethereum Valuation

The decentralized finance sector continues to be a major source of demand for Ethereum. Total value locked in DeFi protocols remains substantial, creating consistent demand for ETH as collateral and gas fees. New DeFi innovations regularly emerge, expanding use cases and attracting new users to the Ethereum ecosystem.

Non-fungible tokens (NFTs) have created an additional use case for Ethereum, though trading volumes have normalized from previous peaks. The NFT market’s maturation has led to more sustainable usage patterns and reduced speculative activity. However, ongoing innovations in digital ownership and creator economies continue to drive utility.

Real World Asset (RWA) tokenization represents an emerging trend that could significantly impact Ethereum demand. Traditional financial instruments and physical assets are increasingly being tokenized on Ethereum, creating new markets and liquidity pools. This trend could drive substantial long-term adoption and value creation. Yield farming and liquidity mining continue to attract users seeking passive income opportunities. These activities require ETH holdings and generate transaction fees, creating positive feedback loops for network usage and token demand.

Institutional Adoption and Ethereum Investment Trends

Institutional adoption of Ethereum has accelerated significantly over the past year. Major corporations, hedge funds, and financial institutions have added ETH to their balance sheets and investment portfolios. This institutional interest provides price stability and reduces volatility compared to purely retail-driven markets.

Exchange-traded funds (ETFs) focused on Ethereum have gained regulatory approval in several jurisdictions, making ETH accessible to traditional investors through familiar investment vehicles. These ETFs have attracted billions in assets under management and continue to grow as more investors seek cryptocurrency exposure.

Pension funds and endowments have begun allocating small percentages of their portfolios to Ethereum, recognizing its potential as a store of value and growth asset. This institutional adoption trend is expected to continue as cryptocurrency becomes more mainstream and regulatory clarity improves.

Corporate treasury allocation to Ethereum remains limited compared to Bitcoin, but is growing as companies recognize ETH’s utility beyond simple value storage. Companies building on Ethereum often hold ETH for operational purposes, creating natural demand from the corporate sector.

Regulatory Environment and Its Effect on ETH Prices

The regulatory landscape for cryptocurrencies continues to evolve, with significant implications for Ethereum price predictions. Recent regulatory developments have generally been supportive of Ethereum’s classification as a utility token rather than a security, providing clarity for investors and developers. International regulatory coordination efforts are underway to establish consistent frameworks for cryptocurrency oversight. These efforts could reduce regulatory uncertainty and support institutional adoption of Ethereum. However, strict regulations in some jurisdictions could limit market access and trading activity.

Central bank digital currencies (CBDCs) worldwide could impact demand for cryptocurrencies like Ethereum. However, many CBDCs are being built on blockchain platforms that could complement rather than compete with Ethereum’s ecosystem. Tax policies regarding cryptocurrency investments continue to evolve, affecting investor behavior and market dynamics. Clear tax guidance has generally been positive for market development and institutional participation.

Competition Analysis: Ethereum vs. Other Blockchain Platforms

Ethereum faces increasing competition from other blockchain platforms offering similar functionality with different trade-offs. Solana, Cardano, Avalanche, and other platforms continue to gain market share and developer mindshare. However, Ethereum maintains significant advantages in network effects, developer ecosystem, and total value locked. The multi-chain future appears to be emerging, with different blockchains specializing in different use cases rather than one platform dominating all applications. This trend could be positive for Ethereum as it focuses on its strengths in DeFi and institutional applications.

Interoperability solutions are developing rapidly, allowing assets and applications to move between different blockchain networks. These developments could reduce the winner-takes-all dynamics and allow multiple platforms to coexist and thrive. Ethereum’s first-mover advantage in smart contracts and developer tools continues to provide significant benefits. The large existing ecosystem of applications, users, and developers creates strong network effects that competitors must overcome.

Risk Factors and Considerations for ETH Investors

Investing in Ethereum involves several risk factors that potential investors should carefully consider. Price volatility remains high compared to traditional assets, and short-term price movements can be dramatic and unpredictable. Technology risks include potential security vulnerabilities, scaling challenges, and competition from newer blockchain platforms. While Ethereum has a strong development team and community, technical issues could impact price performance.

Regulatory risks could significantly affect Ethereum’s price if unfavorable policies are implemented. Changes in tax treatment, trading restrictions, or classification as a security could create headwinds for price appreciation. Market risks include correlation with broader cryptocurrency markets and potential impacts from macroeconomic factors. Economic recessions, inflation, or financial market stress could negatively impact Ethereum prices regardless of fundamental developments.

Future Outlook: Long-term Ethereum Price Predictions

Long-term price predictions for Ethereum vary widely among analysts and experts. Bullish scenarios envision Ethereum capturing significant value from the digitalization of finance and the growth of Web3 applications. These scenarios suggest substantial price appreciation over multi-year timeframes. Conservative estimates focus on Ethereum’s growing utility and adoption while acknowledging competition and regulatory uncertainties. These projections suggest steady but moderate price growth aligned with network usage and economic activity.

Bearish scenarios consider potential technology disruption, regulatory crackdowns, or fundamental shifts in how blockchain technology is used and valued. While these scenarios are considered less likely by most experts, they represent important tail risks for investors to consider. The consensus among most analysts appears to be cautiously optimistic about Ethereum’s long-term prospects, with expectations for continued growth tempered by awareness of various risk factors and uncertainties.

Conclusion

Staying informed about Ethereum price prediction news today requires understanding multiple factors that influence ETH valuation. From technical analysis and market sentiment to regulatory developments and network upgrades, numerous variables contribute to Ethereum’s price movements. While predictions provide valuable insights, they should be viewed as one component of a comprehensive investment strategy rather than definitive forecasts.

The Ethereum ecosystem continues to evolve and mature, creating new opportunities and challenges for investors. Success in cryptocurrency investing requires continuous learning, risk management, and adaptation to changing market conditions. Whether you’re actively trading or building a long-term position, staying updated with reliable Ethereum price prediction news today can help inform your decision-making process.