Sui Price Prediction Investment Guide 2025 Expert Analysis & Forecasts

The cryptocurrency market continues to evolve at a breakneck speed, with innovative blockchain projects capturing the attention of investors worldwide. Among these emerging platforms, Sui Network has distinguished itself as a revolutionary Layer-1 blockchain that promises to reshape the digital asset landscape. This comprehensive SUI price prediction investment guide provides essential insights for investors seeking to understand SUI’s potential trajectory and make informed decisions in 2025 and beyond.

Sui Network’s unique object-centric architecture and lightning-fast transaction processing have positioned it as a serious contender in the competitive blockchain space. As traditional blockchains struggle with scalability issues, Sui’s parallel processing capabilities and sub-second finality make it an attractive option for both developers and investors. Whether you’re a seasoned crypto investor or a newcomer to the space, this Sui price prediction investment guide will equip you with the knowledge needed to navigate SUI’s investment potential effectively.

Sui Network: The Foundation of Price Predictions

Before diving into price predictions, it’s crucial to understand what makes Sui Network unique in the blockchain ecosystem. Developed by Mysten Labs, a team of former Meta engineers who worked on the Diem project, Sui represents a paradigm shift in blockchain architecture.

Core Technology and Innovation

Sui’s object-centric model treats digital assets as programmable objects rather than simple ledger entries. This approach enables unprecedented scalability and efficiency, allowing the network to process up to 300,000 transactions per second. The platform utilizes the Move programming language, originally developed for Facebook’s Libra project, which provides enhanced security and reduces common smart contract vulnerabilities.

The network’s consensus mechanism, called Mysticeti, achieves sub-second finality while maintaining decentralization. This technological foundation creates a robust platform for decentralized applications (dApps), particularly in gaming, DeFi, and NFT sectors.

Market Position and Competitive Advantages

Sui’s market position strengthens through several key differentiators:

- Horizontal Scaling: Unlike vertical scaling solutions, Sui can add more processing power simply by adding validators

- Low Transaction Costs: Average fees remain around $0.001 per transaction

- Developer-Friendly: The Move programming language reduces development complexity

- Institutional Backing: Strong support from major investors, including Andreessen Horowitz and Binance Labs

Sui Price Prediction Investment Guide: Technical Analysis

Historical Price Performance

Since its mainnet launch in May 2023, SUI has experienced significant volatility typical of emerging cryptocurrencies. The token reached its all-time high of $5.35 in January 2025, representing substantial gains from its initial trading price. Understanding these historical patterns provides valuable context for future predictions.

Key milestones in SUI’s price history include:

- Initial trading around $0.50 (May 2023)

- First major rally to $2.00 (August 2023)

- Market correction to $0.80 (November 2023)

- Recovery and new highs in early 2025

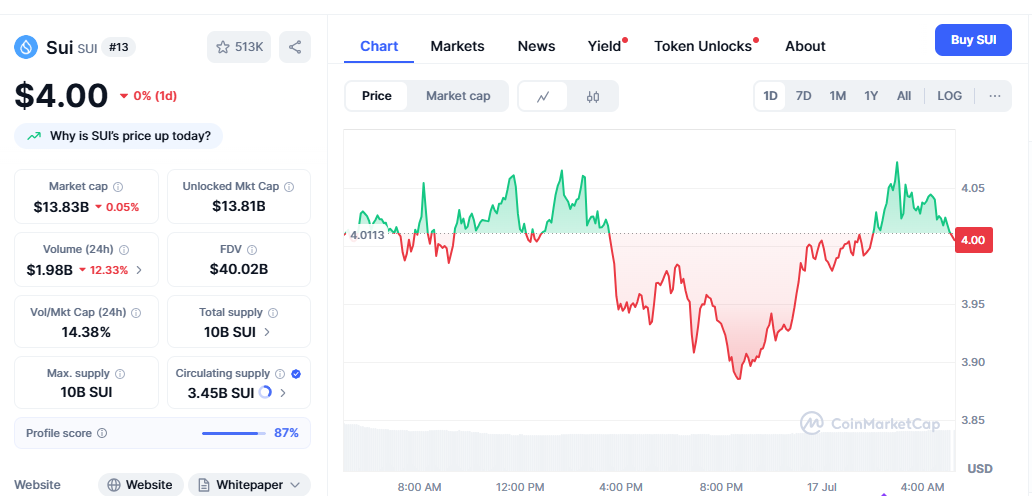

Technical Indicators and Chart Analysis

Current technical analysis reveals several important trends:

Support and Resistance Levels:

- Strong support at $3.50-$3.80 range

- Immediate resistance at $4.50-$5.00

- Long-term resistance at the previous ATH of $5.35

Moving Averages:

- 50-day MA trending upward, indicating bullish momentum

- 200-day MA provides strong support

- Golden cross formation suggesting potential continued upward movement

Volume Analysis: Daily trading volume consistently exceeds $500 million, indicating strong market interest and liquidity.

Fundamental Analysis for Sui Investment Strategy

Network Adoption and Usage Metrics

The growth of Sui’s ecosystem directly impacts its investment potential. Key metrics to monitor include:

Developer Activity:

- Over 500 active projects building on Sui

- Monthly developer commits show consistent growth

- Strong GitHub community engagement

Transaction Volume:

- Daily transaction count exceeding 10 million

- Growing DeFi Total Value Locked (TVL)

- Increasing NFT marketplace activity

Partnership Ecosystem: Strategic partnerships with major gaming studios, DeFi protocols, and enterprise clients create multiple value drivers for SUI token appreciation.

Tokenomics and Supply Dynamics

Understanding SUI’s tokenomics is crucial for any investment strategy:

Total Supply: 10 billion SUI tokens (fixed cap) Current Circulating Supply: Approximately 3.5 billion tokens Inflation Rate: Decreasing over time due to the token unlock schedule

The token distribution includes:

- 50% Community Reserve (managed by Sui Foundation)

- 20% Early Contributors (vesting until 2030)

- 14% Investors (gradual unlock schedule)

- 10% Treasury

- 6% Community Access Program

Market Sentiment and External Factors

Regulatory Environment Impact

The regulatory landscape has a significant influence on cryptocurrency prices. Sui’s approach to compliance, combined with its development team’s experience with regulatory frameworks, positions it favorably for institutional adoption.

Macro Economic Factors

Several macroeconomic factors affect SUI’s price trajectory:

- Federal Reserve interest rate policies

- Institutional cryptocurrency adoption

- Global economic stability

- Blockchain technology acceptance

Competitive Landscape Analysis

Sui competes with established Layer-1 blockchains including Ethereum, Solana, and Aptos. Its unique value proposition and technological advantages provide competitive moats that support long-term price appreciation.

Sui Price Prediction Investment Guide 2025 Forecasts

Short-Term Predictions (3-6 months)

Based on current market conditions and technical analysis, several scenarios emerge:

Bullish Scenario ($6.00-$8.00):

- Continued ecosystem growth and developer adoption

- Major partnership announcements

- Positive regulatory developments

- Strong overall crypto market sentiment

Moderate Scenario ($4.50-$6.00):

- Steady ecosystem development

- Stable market conditions

- Gradual institutional adoption

Bearish Scenario ($2.50-$4.00):

- Market correction or bear market

- Regulatory uncertainty

- Competitive pressure from other Layer-1 platforms

Long-Term Projections (1-3 years)

Long-term price predictions consider fundamental growth drivers:

2025 Year-End Target: $8.00-$12.00

- Mature ecosystem with hundreds of dApps

- Significant DeFi and gaming adoption

- Enterprise partnerships driving utility

2026-2027 Outlook: $10.00-$20.00

- Potential integration with major financial institutions

- Cross-chain interoperability solutions

- Widespread consumer adoption

Also Read: 7 Cheapest Ways to Buy Bitcoin (BTC) in 2024

Risk Assessment and Investment Considerations

Investment Risks

Every cryptocurrency investment carries inherent risks:

Technical Risks:

- Smart contract vulnerabilities

- Network congestion issues

- Scalability challenges during rapid growth

Market Risks:

- Cryptocurrency market volatility

- Regulatory changes

- Competition from established platforms

Operational Risks:

- Team execution challenges

- Partnership dependencies

- Technology adoption timeline

Risk Mitigation Strategies

Successful SUI investment requires proper risk management:

- Diversification: Don’t invest more than 5-10% of your portfolio in any single cryptocurrency

- Dollar-Cost Averaging: Spread purchases over time to reduce timing risk

- Stop-Loss Orders: Set predetermined exit points to limit losses

- Research Updates: Stay informed about project developments and market changes

Investment Strategies for SUI Token

Active Trading Approach

For experienced traders, SUI offers several opportunities:

Day Trading: High volatility provides intraday profit opportunities Swing Trading: Medium-term positions based on technical analysis Arbitrage: Price differences across exchanges

Long-Term Holding Strategy

Long-term investors should consider:

Staking Rewards: Earn passive income through network participation Ecosystem Participation: Engaging with Sui dApps and services Portfolio Rebalancing: Regularly adjusting position sizes

DeFi Integration Opportunities

Sui’s DeFi ecosystem offers additional investment avenues:

- Yield farming protocols

- Liquidity provision

- Lending and borrowing platforms

Monitoring Your SUI Investment

Key Metrics to Track

Successful SUI investment requires monitoring various indicators:

On-Chain Metrics:

- Active addresses

- Transaction volume

- Network usage statistics

Development Metrics:

- GitHub activity

- Developer count

- New project launches

Financial Metrics:

- Trading volume

- Market cap ranking

- Price correlations

Tools and Resources

Essential tools for SUI investment tracking:

- CoinGecko and CoinMarketCap for price data

- Sui Explorer for on-chain analytics

- DeFiLlama for ecosystem TVL tracking

- Social media sentiment analysis tools

Expert Opinions and Market Analysis

Institutional Perspectives

Major investment firms and analysts have shared their views on Sui’s potential: Leading crypto research firm Messari highlights Sui’s innovative approach to blockchain scalability as a key differentiator in the competitive Layer-1 space. Their analysis suggests that Sui’s object-centric model could capture significant market share from existing platforms.

Community Sentiment

The Sui community continues to grow, with active participation in governance and ecosystem development. Community-driven initiatives and strong developer engagement create positive momentum for long-term price appreciation.

Conclusion

This comprehensive SUI price prediction investment guide reveals significant potential for SUI’s price appreciation based on strong fundamentals, innovative technology, and growing ecosystem adoption. The network’s unique architecture positions it well for capturing market share in the competitive blockchain space.

FAQs

What makes Sui different from other cryptocurrencies?

Sui’s object-centric architecture and parallel processing capabilities distinguish it from traditional blockchains. The network can process transactions simultaneously rather than sequentially, resulting in higher throughput and lower latency.

Is SUI a good long-term investment?

SUI exhibits strong potential for long-term growth, driven by its innovative technology, experienced team, and expanding ecosystem. However, like all cryptocurrency investments, it carries significant risks and should be part of a diversified portfolio.

How high can the SUI price go in 2025?

Based on current analysis, SUI could potentially reach $8-$12 by the end of 2025, assuming continued ecosystem growth and favorable market conditions. However, cryptocurrency markets are highly volatile and unpredictable.

What factors influence SUI’s price?

Key factors include network adoption, developer activity, partnership announcements, regulatory developments, overall crypto market sentiment, and technological upgrades to the Sui platform.

Should I buy SUI now or wait?

Investment timing depends on your risk tolerance, investment horizon, and market analysis. Consider dollar-cost averaging to reduce timing risk, and never invest more than you can afford to lose.