White BIT Coin Price Prediction 2025 Complete Analysis & Investment Guide

The cryptocurrency market continues to evolve rapidly, with exchange tokens gaining significant attention from investors worldwide. Among these promising digital assets, WhiteBIT Coin (WBT) has emerged as a noteworthy player in the exchange token ecosystem. Our comprehensive WhiteBIT Coin price prediction 2025 analysis examines the potential growth trajectory of this utility token, considering market trends, technological developments, and fundamental factors that could influence its value.

WhiteBIT exchange has established itself as a reputable trading platform, and its native token WBT serves multiple purposes within the ecosystem. As we approach 2025, investors are increasingly interested in understanding the potential price movements of WhiteBIT Coin and whether it represents a viable investment opportunity. This detailed analysis will explore various factors that could impact the token’s performance, providing you with the insights needed to make informed investment decisions.

What is White BIT Coin Price Prediction 2025 (WBT)?

WhiteBIT Coin represents the native utility token of the WhiteBIT cryptocurrency exchange, one of Europe’s fastest-growing digital asset trading platforms. Launched to enhance user experience and provide additional benefits to the exchange’s community, WBT serves multiple functions within the WhiteBIT ecosystem.

The token operates on multiple blockchain networks, ensuring flexibility and accessibility for users. WBT holders enjoy reduced trading fees, access to exclusive features, and participation in various platform initiatives. The token’s utility extends beyond simple fee discounts, incorporating staking rewards, governance rights, and premium service access.

WhiteBIT exchange has demonstrated consistent growth since its inception, expanding its services across multiple jurisdictions and continuously improving its platform infrastructure. This growth directly correlates with the potential value appreciation of WBT, as increased exchange activity typically translates to higher token utility and demand.

White BIT Coin Price Prediction 2025: Technical Analysis

Current Market Position

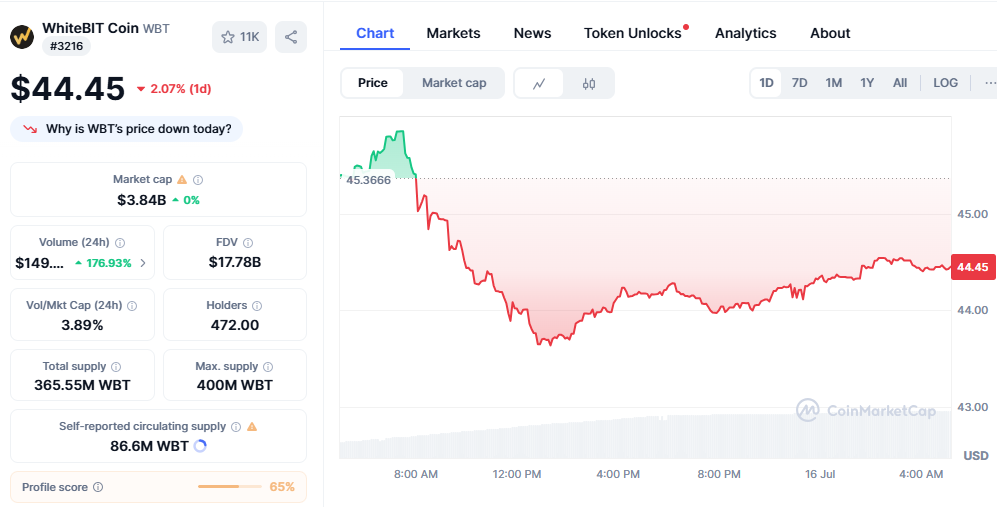

As of late 2024, WhiteBIT Coin has shown resilience in challenging market conditions, maintaining relatively stable price levels compared to many other exchange tokens. The token’s performance has been influenced by several key factors, including exchange growth, market sentiment, and overall cryptocurrency adoption trends.

Technical indicators suggest that WBT has established strong support levels, with trading volumes showing steady improvement throughout 2024. The token’s price action has demonstrated lower volatility compared to many altcoins, indicating a more mature trading environment and growing institutional interest.

Price Projection Models

Our WhiteBIT Coin price prediction 2025 incorporates multiple analytical approaches to provide a comprehensive outlook:

Conservative Estimate: Based on current growth trajectories and market conditions, WBT could reach $0.08-$0.12 by the end of 2025, representing a potential 60-140% increase from current levels.

Moderate Scenario: If WhiteBIT exchange continues its expansion and crypto markets experience moderate growth, WBT could achieve $0.15-$0.25, suggesting a 200-400% potential upside.

Optimistic Projection: In a bullish cryptocurrency market with significant exchange growth, WBT might reach $0.30-$0.50, indicating substantial growth potential of 500-900%.

Factors Influencing

Exchange Growth and User Adoption

The primary driver of WBT’s value lies in WhiteBIT exchange’s continued expansion and user base growth. As more traders join the platform and trading volumes increase, demand for WBT naturally rises due to its utility benefits. The exchange’s strategic expansion into new markets and regulatory compliance efforts position it favorably for sustained growth.

WhiteBIT’s commitment to regulatory compliance and security improvements has enhanced its reputation among institutional investors. This institutional interest could significantly impact WBT’s price trajectory, as large-scale adoption typically results in increased demand and price stability.

Market Sentiment and Cryptocurrency Adoption

The broader cryptocurrency market’s performance will significantly influence our WhiteBIT Coin price prediction 2025. Positive market sentiment, increased institutional adoption, and favorable regulatory developments could create an environment conducive to WBT’s growth.

Global cryptocurrency adoption rates continue to accelerate, with more businesses and individuals recognizing digital assets’ potential. This trend benefits established platforms like WhiteBIT and their native tokens, as increased adoption typically translates to higher trading volumes and token utility.

Technological Developments and Platform Improvements

WhiteBIT’s continuous platform improvements and technological innovations directly impact WBT’s value proposition. The exchange’s development roadmap includes advanced trading features, enhanced security measures, and expanded service offerings that could increase token utility and demand.

Integration with emerging technologies such as decentralized finance (DeFi) protocols and non-fungible tokens (NFTs) could provide additional use cases for WBT, potentially driving price appreciation as the token’s utility expands beyond traditional exchange functions.

Investment Strategies for WhiteBIT Coin

Dollar-Cost Averaging Approach

For investors considering WBT as a long-term investment, dollar-cost averaging represents a practical strategy to mitigate volatility risks. This approach involves making regular purchases over time, reducing the impact of short-term price fluctuations on your overall investment.

Given the cryptocurrency market’s inherent volatility, spreading purchases across multiple periods can help achieve a more favorable average entry price. This strategy is particularly relevant for exchange tokens like WBT, which may experience periodic price swings based on market conditions and exchange performance.

Fundamental Analysis Considerations

Evaluating WBT’s fundamental value requires examining WhiteBIT exchange’s financial health, user growth metrics, and competitive positioning. Key indicators include daily trading volumes, user acquisition rates, revenue growth, and market share within the European cryptocurrency exchange landscape.

The token’s utility features, including fee discounts and staking rewards, provide intrinsic value that can help establish price floors during market downturns. Understanding these fundamental factors is crucial for making informed investment decisions based on our WhiteBIT Coin price prediction 2025.

Risk Factors and Considerations

Regulatory Challenges

Cryptocurrency regulations continue to evolve globally, with potential impacts on exchange operations and token values. Changes in regulatory frameworks could affect WhiteBIT’s operations and, consequently, WBT’s price performance. Investors should monitor regulatory developments in key markets where WhiteBIT operates.

European Union regulations, particularly the Markets in Crypto-Assets (MiCA) regulation, could significantly impact WhiteBIT’s operations and WBT’s classification. While regulatory clarity generally benefits established platforms, compliance costs and operational adjustments may temporarily affect token performance.

Market Competition

The cryptocurrency exchange landscape remains highly competitive, with established players and new entrants continuously vying for market share. WhiteBIT’s ability to maintain its competitive position and continue growing its user base will directly impact WBT’s long-term value proposition.

Competition from both centralized and decentralized exchanges presents ongoing challenges. However, WhiteBIT’s focus on user experience, security, and regulatory compliance provides competitive advantages that could support WBT’s price appreciation in 2025.

Also Read: Monero Price Prediction Next 5 Years Complete Analysis & Expert Forecasts (2025-2030)

Technical Risks

Like all cryptocurrency investments, WBT faces technical risks including smart contract vulnerabilities, blockchain network issues, and cybersecurity threats. While WhiteBIT has implemented robust security measures, these risks remain inherent to the cryptocurrency ecosystem.

The token’s multi-chain nature, while providing flexibility, also introduces complexity and potential technical challenges. Investors should consider these factors when evaluating WBT’s risk-reward profile for 2025.

Comparison with Other Exchange Tokens

Binance Coin (BNB) Analysis

Binance Coin serves as the gold standard for exchange tokens, demonstrating how successful platforms can drive substantial token value appreciation. While WhiteBIT operates on a smaller scale, its growth trajectory and European market focus provide unique advantages that could support WBT’s price development.

BNB’s success story offers insights into potential catalysts for WBT’s growth, including expanded utility, burn mechanisms, and ecosystem development. However, investors should recognize that replicating BNB’s success requires significant platform growth and market adoption.

FTX Token (FTT) Lessons

The FTX Token’s dramatic collapse highlighted the importance of platform stability and governance in exchange token valuations. WhiteBIT’s conservative approach and regulatory compliance focus provide advantages in building sustainable token value, contrasting with more aggressive but ultimately unsustainable growth strategies.

This comparison emphasizes the importance of evaluating platform fundamentals when considering exchange token investments, making our WhiteBIT Coin price prediction 2025 analysis focus on sustainable growth factors rather than speculative price movements.

Trading Strategies and Market Timing

Short-term Trading Opportunities

For active traders, WBT presents various short-term opportunities based on market cycles and exchange-specific news. Technical analysis can help identify optimal entry and exit points, particularly during periods of increased volatility or significant platform announcements.

However, short-term trading requires significant market knowledge and risk management skills. The cryptocurrency market’s 24/7 nature and high volatility can create substantial risks for inexperienced traders attempting to profit from short-term price movements.

Long-term Investment Horizon

Long-term investors may find WBT attractive due to its utility within a growing exchange ecosystem. The token’s fundamental value proposition, combined with WhiteBIT’s expansion plans, could provide steady appreciation over extended periods.

Our WhiteBIT Coin price prediction 2025 suggests that long-term holders may benefit from the exchange’s continued growth and the token’s increasing utility. However, investors should maintain realistic expectations and understand that cryptocurrency investments carry inherent volatility.

Future Developments and Catalysts

Platform Expansion Plans

WhiteBIT’s strategic expansion into new markets could significantly impact WBT’s value in 2025. The exchange’s plans to increase its global presence and introduce new services may create additional demand for the token through expanded utility and user base growth.

Geographic expansion requires significant investment in compliance and infrastructure, but successful implementation could substantially increase the platform’s total addressable market and, consequently, WBT’s potential value.

Partnership and Integration Opportunities

Strategic partnerships with other cryptocurrency platforms, financial institutions, and technology providers could enhance WBT’s utility and market position. These collaborations may introduce new use cases and increase token demand beyond traditional exchange functions.

Integration with emerging blockchain technologies and participation in industry initiatives could position WBT as a valuable asset within the broader cryptocurrency ecosystem, potentially supporting price appreciation in 2025.

Conclusion

Our comprehensive WhiteBIT Coin price prediction 2025 analysis reveals significant potential for growth, driven by exchange expansion, increasing cryptocurrency adoption, and enhanced token utility. While the cryptocurrency market remains volatile and unpredictable, WBT’s fundamental value proposition and WhiteBIT’s strategic positioning suggest positive long-term prospects.

The token’s multiple use cases within the WhiteBIT ecosystem, combined with the exchange’s commitment to regulatory compliance and user experience, provide a solid foundation for potential value appreciation. However, investors must carefully consider the risks associated with cryptocurrency investments and conduct thorough due diligence before making investment decisions.

FAQs

What is the WhiteBIT Coin price prediction for 2025?

Based on current market analysis and platform growth projections, WBT could reach $0.08-$0.50 by 2025, depending on market conditions and exchange performance. Conservative estimates suggest $0.08-$0.12, while optimistic scenarios project $0.30-$0.50.

How does WhiteBIT Coin generate value for holders?

WBT provides multiple benefits, including reduced trading fees, staking rewards, access to premium features, and potential capital appreciation. The token’s utility within the WhiteBIT ecosystem creates intrinsic value that supports its market price.

Is WhiteBIT Coin a good investment for 2025?

WBT may represent a viable investment opportunity for those bullish on WhiteBIT exchange’s growth prospects and the broader cryptocurrency market. However, investors should conduct thorough research and consider their risk tolerance before making investment decisions.

What factors could negatively impact WhiteBIT Coin’s price?

Potential negative factors include regulatory challenges, increased competition, technical issues, broader market downturns, and reduced exchange activity. These risks should be carefully considered when evaluating WBT’s investment potential.

How can I buy WhiteBIT Coin safely?

WBT can be purchased through WhiteBIT exchange and other reputable cryptocurrency trading platforms. Ensure you use secure wallets, enable two-factor authentication, and follow best practices for cryptocurrency security.